Introduction

It can be difficult to navigate the American healthcare system, particularly for foreigners. Because American medical costs are among the highest in the world, having health insurance is now more than just a convenience—it’s a need. Getting the right health insurance is essential whether you’re a tourist, an expat, or an international student. This article will assist you as a foreigner navigate the requirements and possibilities for health insurance in the United States.

Why Health Insurance is Essential

In the US, private healthcare is the norm, and medical expenses may become unmanageable without insurance. A basic medical appointment may cost several hundred dollars, while hospital stays or emergency care might cost thousands or even hundreds of thousands. By providing financial security and peace of mind and paying for a sizable amount of medical bills, health insurance helps to reduce these costs.

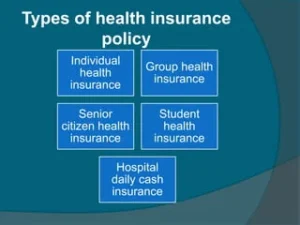

Types of Health Insurance for Foreigners

1. Health Insurance for Travelers

Who needs it: Tourists and short-term guests are the ones who need it.

Coverage: includes accidents, emergency medical costs, and even canceled travel.

Duration: Usually refers to the total amount of time you spend there, up to a maximum of 12 months.

Pros: Easy to buy and reasonably priced.

Cons: Not as comprehensive as other sorts.

2. Global Health Insurance

Who needs it: Both foreign nationals and frequent tourists need it.

Coverage: Full medical treatment, including emergency care, specialist visits, and regular check-ups.

Duration: Long-term purchases are possible; these are frequently renewed yearly.

Pros: Wide coverage that is applicable in several nations.

Cons: Costlier than trip insurance.

3. Health Insurance for Students

Who needs it: International students enrolled in U.S. universities are the ones who require it.

Coverage: Usually consists of mental health treatments, regular and emergency medical attention, and occasionally dental and eye care.

Duration: May be extended; typically, it lasts for the whole school year.

Pros: Often economical, and adapted to the requirements of the kids.

Cons: There might not be as many coverage possibilities off campus.

4. Health Insurance Provided by Employers

Who needs it: The people who need it are foreign employees of American corporations.

Coverage: Varies greatly but usually entails full medical treatment.

Duration: For the duration that you work for the firm.

Pros: Frequently provided by the employer with choices for family coverage.

Cons: Restricted to the length of work

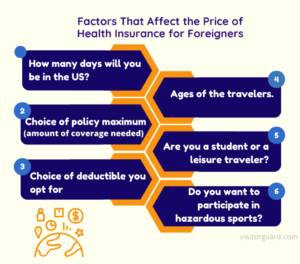

Key Considerations When Choosing a Plan

Coverage Area: Verify that the plan has coverage for the areas you will be traveling to and living in.

Network Providers: Verify whether the hospitals and physicians of your choice are part of the insurer’s network.

Coverage Limits: Recognize the upper limits of coverage as well as any sub-limits applicable to certain services.

Co-payments and Deductibles: Before the insurance takes effect, be informed of the out-of-pocket expenses.

Previous Health Issues: Verify if pre-existing medical problems are included or not.

Exclusions from Policy: To find out what the policy does not cover, read the tiny print.

How to Purchase Health Insurance

- Investigate and Compare policies: Make use of Internet comparison tools to assess several insurance policies according to factors like price, coverage, and client feedback.

- Speak with an Insurance Broker: Brokers can assist you in locating a plan that suits your needs and offers tailored guidance.

- Purchase Straight from Insurers: A lot of websites for insurance firms provide direct purchase choices.

- Plans offered by Universities or Employers: If you are a student or employee, inquire about the plans that are offered by your university or employer. CLICK HERE FOR MORE INFORMATION

Conclusion:

A vital component of being a foreigner living or visiting the US is having health insurance. Essential coverage, assurance, and defense against excessive medical expenses can all be obtained with the correct insurance plan. You can guarantee that you have access to high-quality healthcare without breaking the bank by being aware of your alternatives and putting considerable thought into the plan that best suits your needs.

It might be difficult to navigate health insurance in a foreign nation, but with the correct knowledge and tools, you can make wise choices that protect your health and financial security.

FAQ:

- In the USA, why am I in need of health insurance?

Because medical treatment is so expensive in the United States, having health insurance is necessary. Without insurance, large surgeries can put a person in financial difficulties and even small medical treatments can be costly.

- What is the best way to select a health insurance plan?

Take into account variables such as coverage limitations, network providers, deductibles, co-pays, and exclusions. To make an educated choice, consider your health requirements, the length of your stay, and your financial circumstances

- After coming to the USA, is it possible for me to get health insurance?

Yes, as soon as you get to the United States, you may get health insurance. To make sure you are protected as soon as you arrive, it is advised that you obtain insurance before your trip.